Empowering Fisherfolk in Ajuy, Iloilo through Financial Literacy Seminar

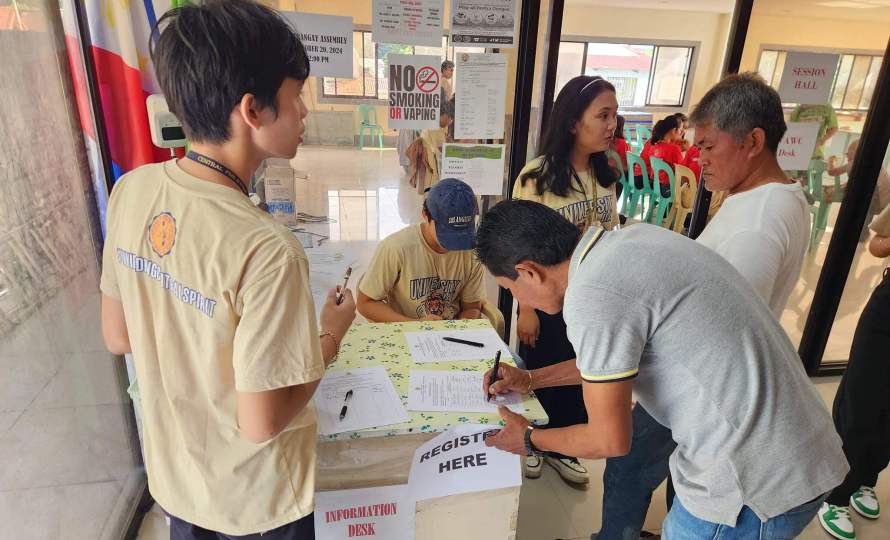

In the picturesque coastal town of Ajuy, Iloilo, the rhythm of life is intricately woven with the sea. For generations, fisherfolk have relied on the ocean's bounty for their livelihood. However, as the tides of modernity sweep the globe, many of these hardworking individuals grapple with financial instability and uncertainty. Recognizing this pressing issue, the CPU College of Agriculture, Resources, and Environmental Sciences (CPU-CARES), together with the University Community Engagement and Service Learning on October 18, 2024, has taken a commendable initiative to empower these fisherfolk through a comprehensive financial literacy seminar. This program aims to enhance their understanding of financial management and uplift their quality of life, ensuring they can navigate the complexities of today's economy with confidence and resilience.

The importance of financial literacy cannot be overstated, especially in communities where traditional livelihoods are at risk. In Ajuy, many fishermen operate hand-to-mouth and often have limited knowledge and skills to manage their finances effectively. This lack of financial acumen can lead to a cycle of poverty, where unexpected expenses or market fluctuations can devastate their fragile economic situation. Moreover, the fishing industry is susceptible to various external factors, including climate change and fluctuating fish populations. Fishermen may be ill-prepared for these challenges without a solid understanding of budgeting, saving, and investing. The CPU-CARES and the invited speaker from Landbank Iloilo held a seminar to address this gap by providing practical knowledge that empowers participants to make informed financial decisions. By equipping them with essential skills, the initiative aims to break the cycle of poverty and foster a more sustainable future for these communities.

It is meticulously designed to address the unique circumstances faced by fishermen. The curriculum encompasses various topics, including budgeting, saving strategies, investment options, and understanding credit. Each session is tailored to resonate with the participants' daily lives and challenges, ensuring the information is relevant and actionable. One of the standout features of this seminar is its interactive approach. Participants engage in discussions, share their experiences, and work through real-life scenarios they encounter in their fishing endeavors. This hands-on learning fosters a sense of community and encourages collaboration among fishermen. They learn from the resource speakers and each other, creating a supportive environment where knowledge is shared and built upon. Furthermore, the seminar emphasizes the importance of setting financial goals. By guiding participants through identifying short-term and long-term objectives, they are encouraged to envision a brighter future for themselves and their families. This goal-oriented mindset is crucial in motivating fishermen to adopt better financial practices and improve their economic circumstances.

One of the most significant outcomes of the financial literacy seminar is the boost in confidence it provides to participants. Many fisherfolk enter the program with feelings of uncertainty and inadequacy regarding their financial capabilities. However, their self-assurance grows as they progress through the sessions and gain a deeper understanding of economic concepts. This newfound confidence translates into tangible changes in behavior. Participants begin to take charge of their finances by creating budgets, tracking expenses, and exploring savings options. They become more proactive in seeking investment opportunities and are better equipped to navigate financial institutions. This empowerment extends beyond individual households; as fishermen become more financially savvy, they contribute to the overall economic resilience of their community. Moreover, the seminar fosters a sense of pride among participants. They realize they are not just fishermen; they are entrepreneurs who can take control of their financial destinies. This shift in mindset is invaluable, as it encourages them to pursue innovative ways to enhance their livelihoods—whether through diversifying income sources or exploring sustainable fishing practices.

The impact of the financial literacy seminar extends far beyond immediate financial gains; it lays the groundwork for a sustainable future. By instilling sound financial practices, participants are better equipped to weather economic storms and invest in their families' well-being. This newfound stability can lead to improved health outcomes, educational opportunities for children, and greater community cohesion. Additionally, as fisherfolk become more financially literate, they are more likely to engage with local markets and businesses. This engagement fosters economic growth within Ajuy, creating a ripple effect that benefits not only individual families but the entire community. The seminar catalyzes change, inspiring participants to think critically about their roles in the local economy and encouraging them to advocate for policies that support sustainable fishing practices.

In conclusion, the financial literacy seminar initiated by CPU-CARES is a transformative initiative that empowers fisherfolk in Ajuy, Iloilo. This program equips participants with the tools necessary to navigate an increasingly complex economic landscape by addressing the critical need for financial education and providing tailored resources. As these individuals gain confidence and knowledge, they are poised to create a brighter future for themselves and their community. The ripple effects of this empowerment will undoubtedly resonate for generations to come, ensuring that their rich fishing heritage thrives alongside its people’s aspirations for a sustainable and prosperous life.